Insights into 2025: Opportunities and Challenges for China’s Manufacturing Industry

2025, the closing year of China’s 14th Five-Year Plan, marks a critical turning point for the nation’s manufacturing sector. It is a year of concentrated policy and technological releases, accelerated structural adjustment, and increasingly differentiated competition. Opportunities and challenges coexist, with growth and pressure intertwined, shaping the landscape of China’s manufacturing.

1. Dual Drivers: Policy and Market Support

Policy Momentum Strengthens Growth and Manufacturing

The Ministry of Industry and Information Technology (MIIT) emphasizes advancing traditional industry upgrades while fostering emerging sectors, focusing on “strengthening advantages and filling gaps.” Measures such as tax cuts, R&D incentives, and medium- to long-term loans provide cash flow stability and technical support, giving manufacturers confidence amid a complex market environment.

Technology Innovation Accelerates Industrial Upgrading

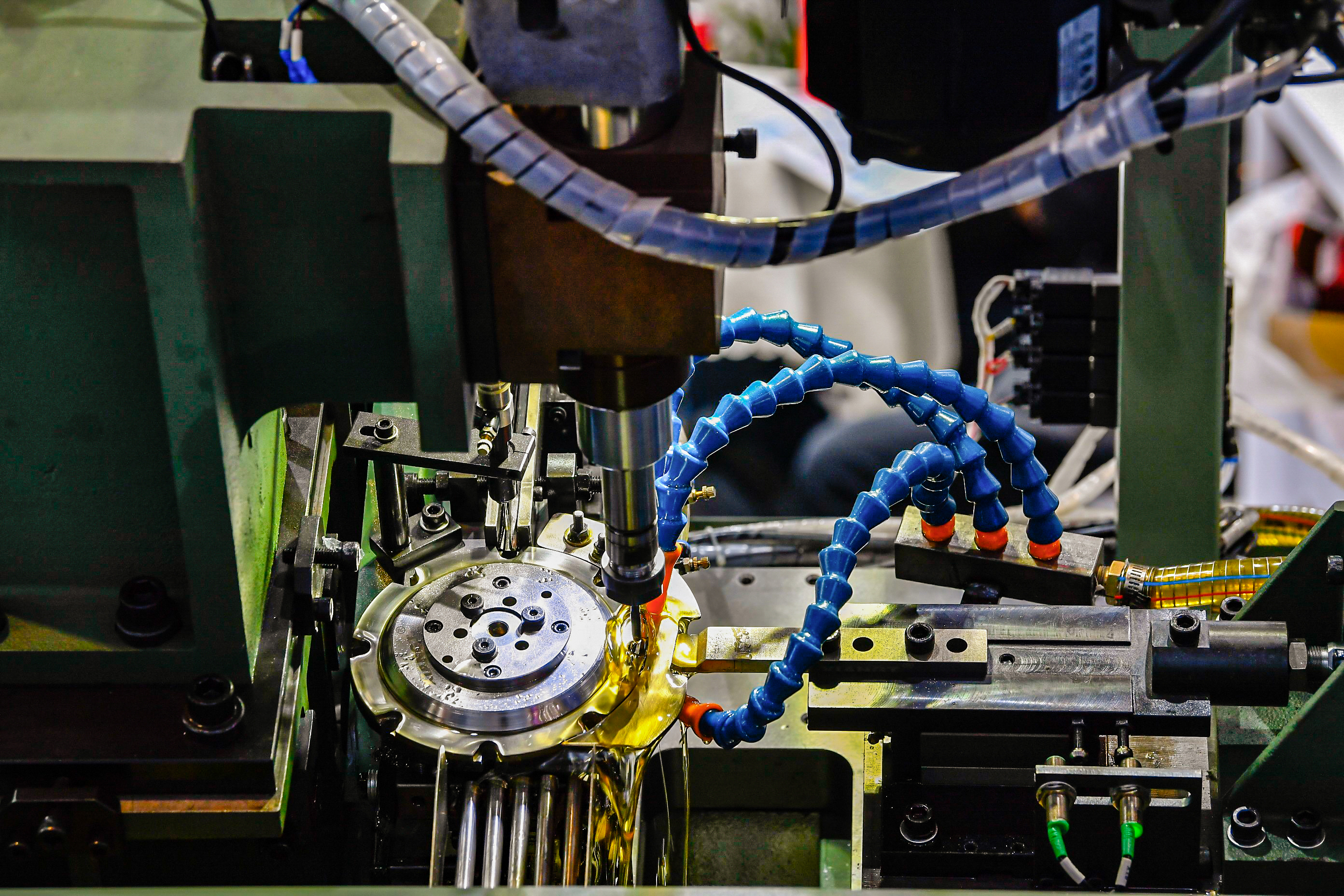

Smart manufacturing, automation, and digitalization are moving from pilot demonstrations to large-scale adoption. The deep integration of AI with industrial software is reshaping production efficiency and cost structures, facilitating the shift from scale-driven to efficiency- and technology-driven manufacturing.

Expanding Domestic Demand and Application Scenarios

Rapid growth in connected vehicles, new energy vehicles, intelligent equipment, and rail transport not only drives whole-machine production but also stimulates upstream demand for components and industrial parts. A large domestic market provides relatively stable growth opportunities, particularly amid rising global uncertainties.

Emerging Industries as New Growth Engines

Sectors such as smart vehicles, biomanufacturing, low-altitude economy, new materials, and quantum information are moving from policy guidance to industry implementation. High-barrier, high-growth sectors provide new leverage points for China’s manufacturing to move up the global industrial chain.

2. Persistent Challenges: Structural, Cost, and Risk Pressures

Structural Overcapacity and Intensified Competition

Some traditional manufacturing sectors continue to face slow demand growth and overcapacity. Short-term price competition remains intense, requiring companies to improve technology, optimize processes, and enhance delivery stability.

Pressure from Green Transformation

China’s carbon neutrality goals accelerate low-carbon transformation. Reducing energy consumption, optimizing processes, adopting green energy, and implementing carbon capture technologies are essential but come with high costs and technical requirements, testing companies’ capital and management capacities.

Data Security Risks in Digital Transformation

As digital factories and industrial IoT expand, cybersecurity and data protection challenges increase. Companies must establish comprehensive digital security systems to prevent data loss, system interruptions, and other risks.

Global Supply Chain Volatility and Production Model Adjustment

Geopolitical tensions, trade frictions, and extreme weather increase supply chain uncertainties. Multi-region layouts and localized production help enhance operational resilience, though at higher costs, ensuring long-term competitiveness.

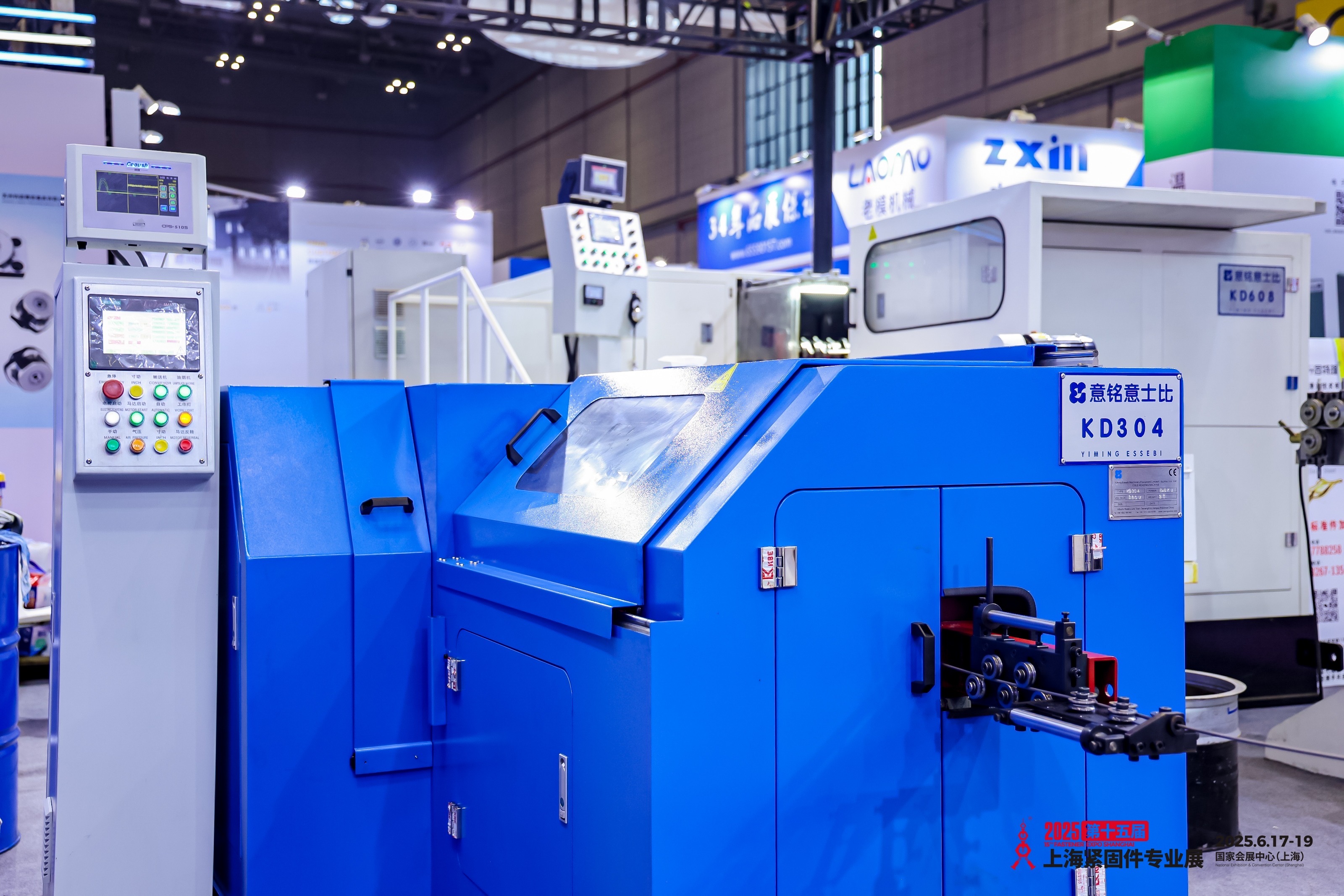

3. Component Exhibitions as a Window into Manufacturing Trends

Focusing on the industry level allows for a more direct observation of the evolving trends in manufacturing. From June 24 to 26, 2026, the Fastener Expo Shanghai 2026 will be held at the National Exhibition and Convention Center in Shanghai. As one of the world’s leading professional component trade shows, the expo not only brings together resources across the industrial chain but also showcases the tangible pathways of manufacturing industry upgrading.

After fifteen successful editions, Fastener Expo Shanghai (FES) has grown into one of the “three major global fastener trade shows.” Its influence is benchmark-setting across multiple dimensions, including exhibitor and product quality, event content, the number of domestic and international buyers, and on-site transaction volume. In 2025, it became the largest fastener exhibition in the world by exhibition area.

Although components are small, they are the most representative fundamental units within the manufacturing system. From fasteners and standard parts to high-performance connectors, their technological level, manufacturing efficiency, and delivery capability directly reflect a country’s true manufacturing strength. It is in these seemingly small elements that Chinese manufacturing is achieving a sustained leap from “quantity” to “quality.”

Official Website: www.fastenerexpo.cn/en

Media Contact: Goblic Hu

Email: goblic.hu@ebseek.com

Phone: +86 138 1631 0340

Please first Loginlater ~